RAC Insurance has launched a new flexible monthly product called Pay by Mile that is aimed at those driving fewer than 6,000 miles a year.

The fully comprehensive car insurance product is in response to the changing needs of motorists – with official figures showing drivers are covering 20 percent fewer miles than two decades ago.

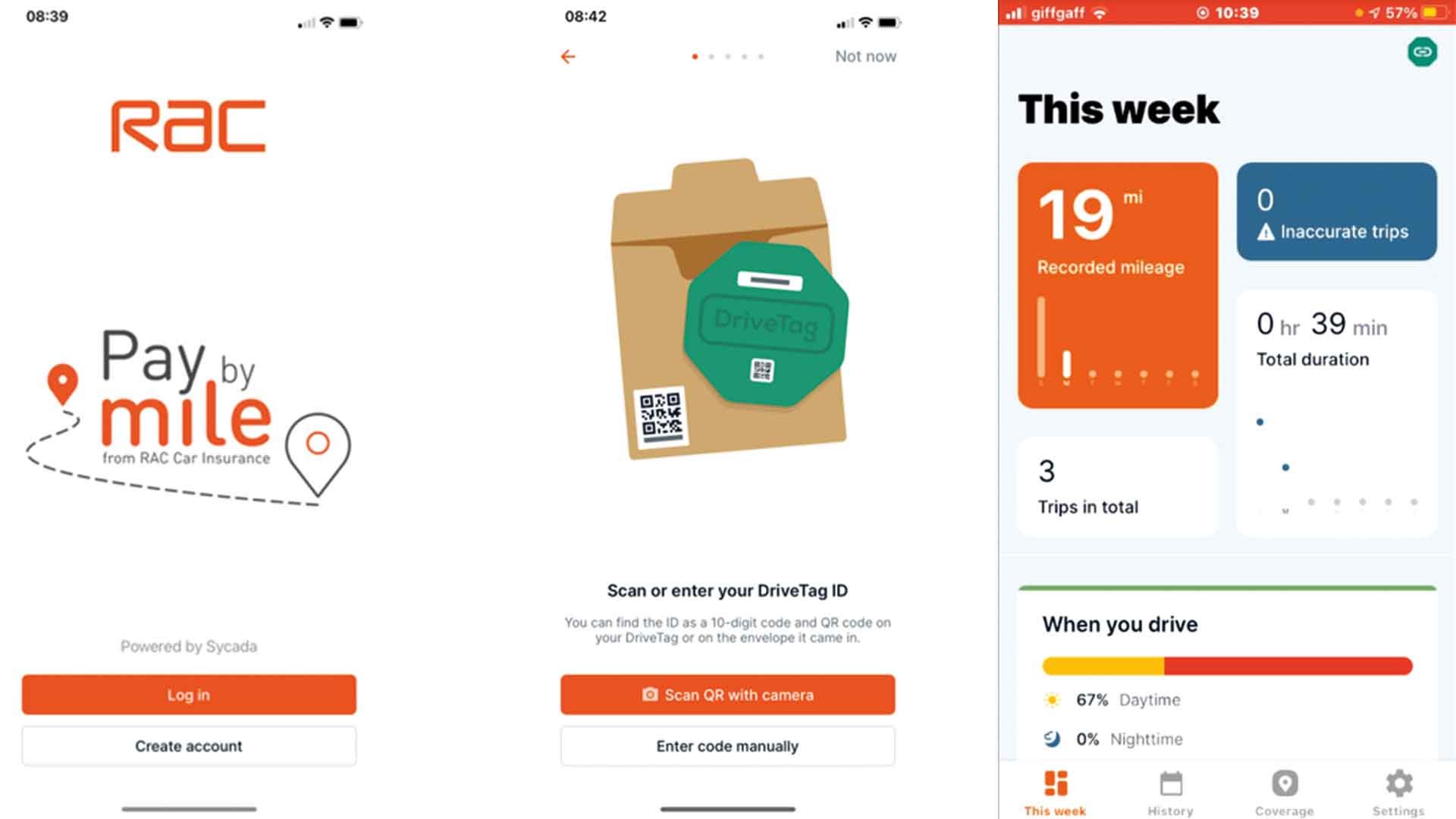

Pay by Mile includes a bespoke app allowing motorists to keep track of miles driven.

Drivers pay an agreed per-mile cost for the miles they drive – the Mileage Premium – and a set monthly fee to cover their car when parked: the Parked Premium.

The Parked Premium is paid at the beginning of each month and the Mileage Premium is paid at the end of the month.

Miles driven are tracked by an RAC ‘drive tag’ that’s stuck to the windscreen. No other data other than miles driven is collected.

The RAC says those who drive relatively few miles may realise significant savings.

There are no fees for changing vehicles or address, and it’s a genuine no-ties product: those who find it’s not suitable, or sell their car, can cancel it straight away with no fees to pay.

Car insurance has been ripe for a shake-up for some time, said RAC Insurance MD Mark Godfrey.

“With a standard car insurance policy, drivers are expected to estimate how many miles they expect to drive from the outset, whether or not they cover this distance during the policy year or not.

“For people who don’t drive very regularly or only ever go short distances, this could result in a premium that seems overly expensive.”

After paying a one-off £50 activation fee and the monthly Parked Premium fee, “drivers just pay a clear ‘per mile’ price of as little as 4p for every mile they actually drive.

“This way, motorists save money for whenever they don’t, or can’t, drive.”

Mr Godfrey said the impact of the coronavirus pandemic on driving matters makes this sort of product more relevant than ever.

RAC Pay by Mile has a minimum £250 excess and is underwritten by Highway Insurance, part of LV=. Motorists must be aged over 21.

ALSO READ

9 surprising ways to cut the cost of car insurance