JLR has introduced a new car insurance package for new and used Range Rover owners who are struggling to find affordable cover.

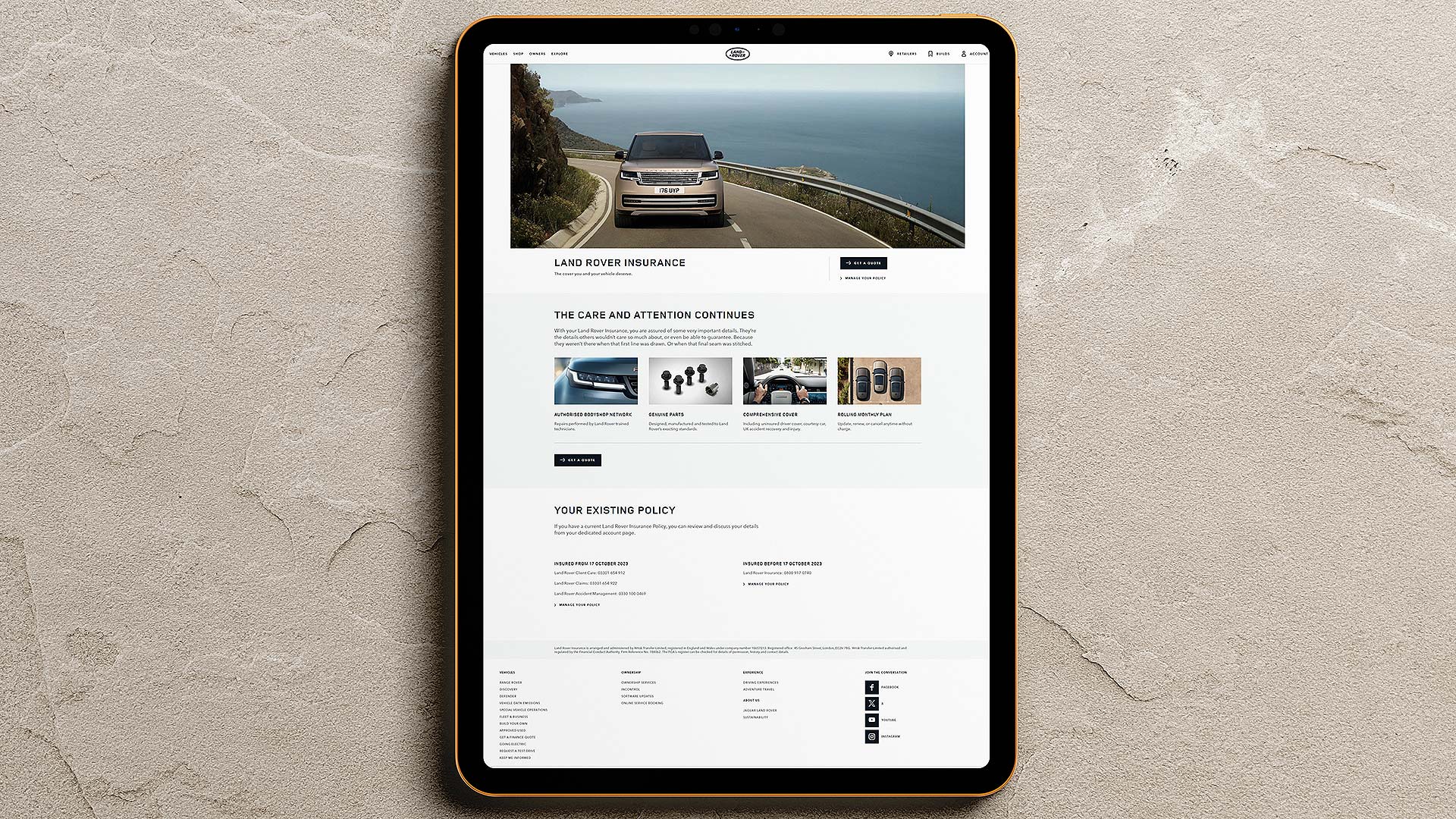

The Land Rover Insurance deal has been trialled since October. It has provided more than 4,000 customers with a JLR car insurance solution.

JLR says monthly premiums for Range Rover insurance are averaging less than £200 for the flexible, subscription-style car insurance package.

It’s the latest move by JLR to help owners who have faced challenges in finding car insurance.

Earlier this month, JLR announced a £10m investment in vehicle security to help reduce keyless car thefts in the UK.

Industry-wide challenge

JLR insists the challenges around high insurance premiums for luxury cars are an industry-wide issue.

“Customers of luxury cars and other luxury goods are experiencing an increase in thefts due to organised criminal activity in the UK,” said JLR UK MD Patrick McGillycuddy.

“The desirability of our luxury vehicles, couples with concerns around thefts, has recently led to challenges in obtaining insurance cover for some clients.”

He said JLR now providing its own car insurance is the latest investment in helping customers.

He added JLR will “continue monitoring and refining our service so that even more clients can take care of it”.

The car insurance package also extends to Jaguars, as well as all other models in the Land Rover line-up.

JLR stats show the new Range Rover and Range Rover Sport, launched in 2022, are proving “highly resilient” to theft.

Of the 12,200 new Range Rovers that are on UK roads, only 9 have been stolen since January 2022. That is a 0.07 percent theft rate.

Of the 13,400 new Range Rover Sport on UK roads, only 13 have been stolen. That is a theft rate of 0.1 percent.

ALSO READ

Slinging mud: passing judgement on the Ineos Grenadier