The Society of Motor Manufacturers has downgraded its 2021 new car registrations forecast as showrooms remain closed during the key March registration plate change month.

Back in January, the SMMT predicted 1.89 million new cars would be registered in 2021.

It has now cut this back to 1.83 million new cars – with “most of these losses expected to occur in March”.

This compares to a record 2.69 million new cars registered just five years ago in 2016.

Industry experts are now declaring April to be the new March, with showrooms due to reopen on 12 April.

The SMMT’s revised figure comes after new car registrations in February 2021 declined 35.5 percent, with more than 28,000 fewer new cars taking to the roads.

Although it’s traditionally a quiet month, the total of 51,312 new car sales makes it the lowest February figure since 1959.

Commentators say it is still a strong performance by the UK auto retail industry, because these sales took place entirely remotely.

The decline of diesel continued, with 61 percent fewer oil-burners registered – only marginally offset by the growth of mild hybrid diesel alternatives.

Electrified alternatives outsold diesel, with the combination of pure electric, plug-in hybrid and regular hybrid taking a 19.3 percent market share.

The Ford Fiesta nosed ahead of the Vauxhall Corsa to take the number one spot in the February best-sellers list, with Nissan’s Qashqai in third place – an impressive result given the imminent launch of the all-new model.

The Corsa still leads the Fiesta in the year-to-date figures, though.

‘Little surprise’

Auto Trader commercial director Ian Plummer said February’s sizeable drop was little surprise.

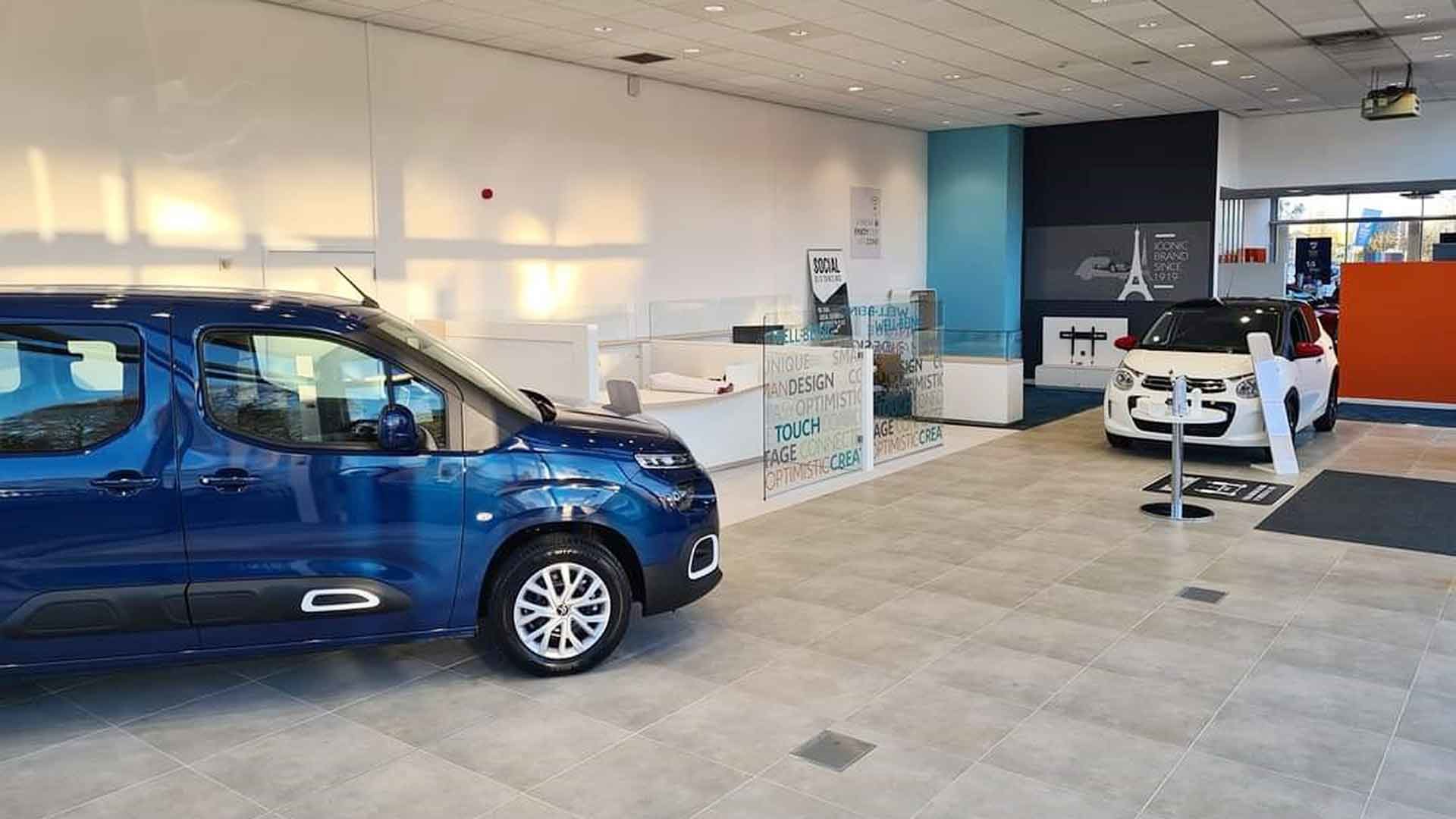

“And confirmation from the Prime Minister that forecourts will have to remain closed during the key sales month of March was disappointing, particularly amongst those that feel car dealerships have retail environments which are at least as safe as other that have been permitted to remain open.

“The government needs to recognise the value in driving car sales as well as local production, both of which contribute major tax revenues the Treasury can surely ill afford to curb.”

Mr Plummer says Auto Trader data still points to a healthy level of pent-up demand though.

Wider economic factors back this up, he added, including Bank of England findings which show average household finances are better off than they were pre-Covid.

“With consumers’ confidence in being able to afford their next car very high… there remain huge opportunities available.”

ALSO READ

Brits won’t own their dream car until they hit 47